Question:

Dear Steve,

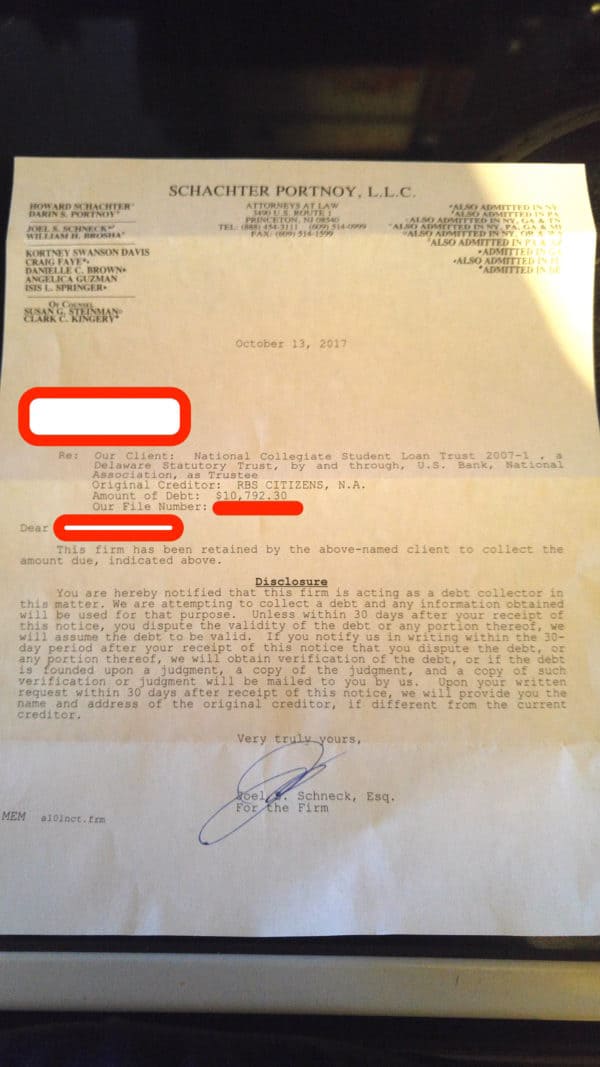

I have a student loan with RBS Citizens bank. Who no longer has the loan their system when I called before. National Collegiate Student Loan Trust. I took the loan out in 2007. My cosigner declared bankruptcy. In 2010 and without warning my loan was put into default and sent to a debt collector. The debt collector harassed me. Telling me I had to pay the loan in full. I hired a lawyer then and they dealt with it. This was probably 2013. Sorry I was young and dumb at the moment and didn’t keep file of details like I should have..

Today I received a letter from a lawyer about my loan with National Collegiate Student Loan Trust. Is there any advice you can give?

Answer:

Dear Jenelle,

The first thing you should do is not panic, but instead take purposeful action. The loans with National Collegiate Student Loan Trust are an utter mess and there is sufficient reason to be concerned if they even have standing to sue you after all this time or if they can prove this is a valid debt.

Recently the Consumer Financial Protection Bureau sued National Collegiate Student Loan Trust and a settlement had been worked out over the problem loans, but one of the lenders stepped in and derailed the proposed settlement.

I think there is sufficient concern over the legality of the suit and collection efforts on this loan. I do publish My List of Student Loan Attorneys You Should Consider for Assistance and while there may not be an attorney who is listed in your state, you could call several of the attorneys listed and ask them if they have any suggestions for your state.

What I know for absolute certain is I am not an attorney and can’t give you legal advice, there are substantial issues surrounding the National Collegiate Student Loan Trust loans that getting a legal opinion from a knowledgeable attorney in your state would the the first thing to do.

Do not ignore the action and letter but also don’t leap to the conclusion that just because someone is attempting to collect the debt that you don’t have options. You absolutely do.

As an example of the types of issues surrounding your loan portfolio see this lawsuit regarding validation and debt collection efforts made on behalf of loans similar to yours.