If the inevitable tradeoffs are ignored, many people could be in support of obtaining a free lunch.

Unfortunately, there ain't no such thing.

A new poll shows that President Joe Biden's decision to forgive $10,000 in education loan debt for many individuals who borrowed money from the authorities to pay for college (and $20,000 for those with need-based Pell Grants) is broadly popular-as long as individuals don't take into account the scheme's knock-on effects. When the potential consequences-including higher inflation and rising educational costs costs, are taken into account-support for student debt forgiveness craters, even among self-identified Democrats.

\”Support for cancelling federal education loan debt plummets when Americans consider its trade-offs,\” writes Emily Ekins, director of polling for that libertarian Cato Institute, which published polling data on student debt forgiveness Thursday. The Cato/YouGov survey includes more than 2,300 Americans and was conducted over six days in mid-August, just prior to the White House's August 24 announcement of the education loan forgiveness plan.

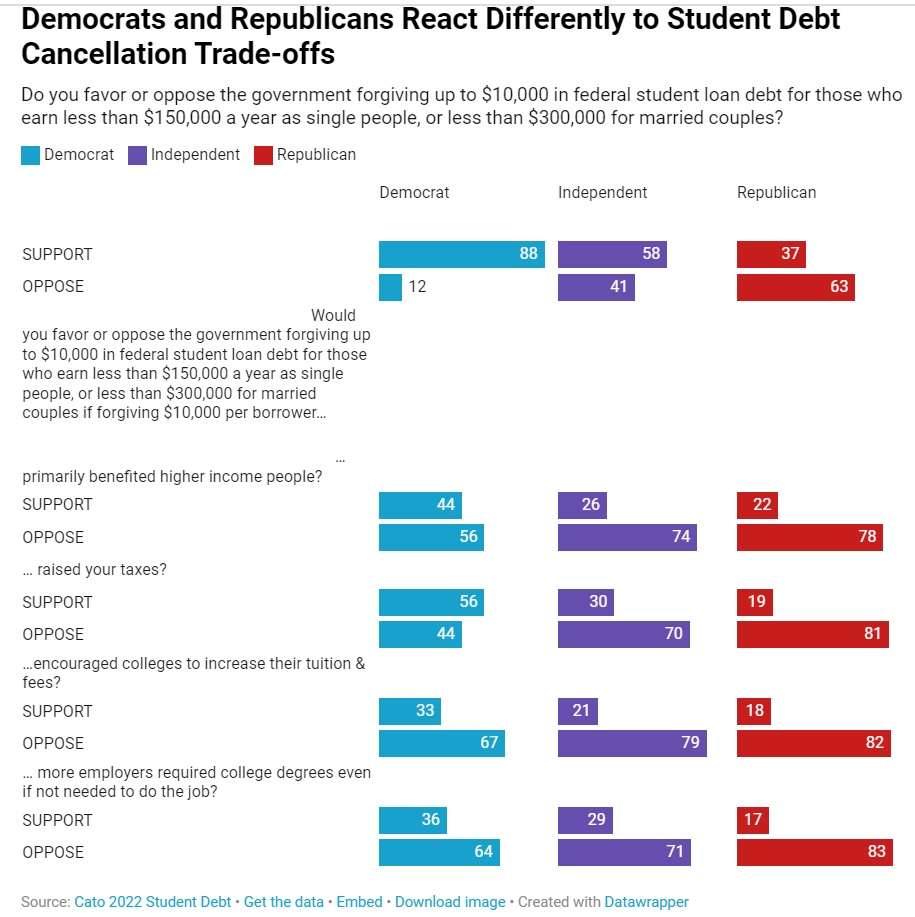

The answers are striking. While 64 percent of respondents (and 88 percent of Democrats) back education loan forgiveness of $10,000 for individuals earning up to $150,000 annually, those totals fall significantly once potential consequences are introduced.

If student loan forgiveness means colleges will raise the prices, for example, support for that policy plummets to 25 percent overall (and 31 percent from Democrats).

But that's probably the most obvious and inevitable consequence of forgiving student debt-and, more accurately, of Biden's decision to change how student loan repayment plans works in the future.

The new loan-repayment structure caps payments like a number of a borrower's income, and therefore the total amount borrowed above the cap becomes effectively meaningless. Colleges will be able to raise tuition to astronomical levels while telling students not to worry about the amount because the things they owe in repayment is going to be capped.

As Reason's Robby Soave explained the 2009 week, the White House has succeeded only in creating even stronger incentives for everyone involved with advanced schooling to fleece students and taxpayers. Even lefty policy wonks like Matt Bruenig have quickly identified the flaws within this idea, that will likely force further government interventions in the near future.

What if education loan forgiveness also caused more employers to want a university degree, even for jobs that someone don't need spending 4 years studying various unrelated topics? When given that possibility, only 29 percent of respondents (and 36 percent of Democrats) within the Cato/YouGov poll say they'd support Biden's policy. Bad, because this is a likely outcome, too.

And let's say the majority of the advantages of student debt forgiveness accrued to wealthier Americans? Then support for that policy falls to 32 percent overall and 44 percent among Democrats.

That's inevitable too since the White House chose to make student loan forgiveness open to individuals earning as much as $125,000 and couples earning as much as $250,000.

Because the ultimate version of Biden's plan included larger levels of debt cancellation for Pell Grant holders and the ongoing repayment caps, the distribution of benefits isn't as skewed as it was once the Penn Wharton Budget Model analyzed the initial version of the proposal. Nevertheless, a revised analysis implies that 62 percent from the benefits will flow to individuals in the upper 60 % of incomes (those earning over $50,100 this year). Instead of being a advantage for the working class, this policy remains mostly a giveaway to upwardly mobile middle- and upper-middle-class Americans with college degrees.

The popularity, or lack thereof, of the policy isn't indicative of its worthiness, obviously. But it is hard to imagine the Biden administration pursuing a policy this legally and economically fraught if not for student debt relief's popularity one of the Democratic base.

That popularity, however, may be something of a mirage. \”These data show that Americans can't stand the expense that many experts feel are related to federal student loan forgiveness,\” says Ekins.

None of this is surprising. A lot more than three years ago, Quinnipiac identified a similar trend inside a poll about student debt settlement. For the reason that survey, a majority supported the idea of giving $50,000 in debt relief to the people from households making less than $250,000 annually, but a majority opposed the idea when told that higher taxes would be essential to pay for it.

It's not clear that there is a direct tax increase necessary to pay for Biden's student debt relief. Instead, the government will simply not collect a few of the future revenue it expected to, that will increase the long-term budget deficit.

Even so, there is no such thing as a free lunch for American education loan borrowers. Democrats will dsicover that there's no such thing as a free lunch at the polls, either.