[Editor's note: This article has been substantially corrected. It originally stated that Warren's childcare plan would cost $1.7 trillion, based on a Moody's estimate. The cost, adjusted for dynamic effects, is $700 billion. The post also said that Warren proposed a teacher pay raise that, based on competing plans, would cost $315 billion. However, Warren only has proposed raising the pay of child care workers as part of her child care plan. The headline of the post stated that Warren's \”budget math still doesn't work\” and argued that, counting on her very own cost estimates her wealth tax wouldn't cover the price of her proposals. That isn't accurate.]

On the campaign trail, Sen. Customer advocates (D -Mass.) is promising voters that they \”has an agenda for that\”-no matter what \”that\” is. But it's unclear her plans works.

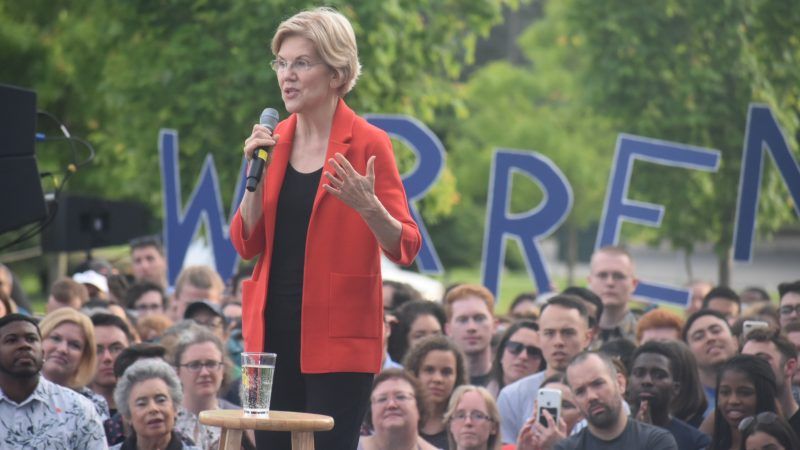

Take Warren's appearance a week ago around the View, where she discussed the n programs she could fund together with her proposed wealth tax of two percent on personal value over $50 million dollars and three percent on value over $1 billion. Warren name-checked her student loan forgiveness and tuition-free college plan, her childcare plan, and a related proposal to improve purchase childcare workers she'd fund with the wealth tax.

According to college of California, Berkeley economists Emmanuel Saez and Gabriel Zucman, Warren's wealth tax would raise $2.75 trillion dollars over the next decade.

Warren's education loan forgiveness and tuition-free college plan would forgive up to $50,000 in student debt owed by households who bring home less than $100,000 in income and will be offering smaller student debt forgiveness to households earning between $100,000 and $250,000. The program also would make every public two-year and four-year college in the united states tuition-free, increase Pell Grant funding by $100 billion, and create a fund to aid historically black colleges and universities (HBCUs). Combined, this plan of action would cost $1.25 trillion over the next decade.

Warren's child-care plan has lots of planks: providing universal pre-K, funding childcare for all, and raising childcare worker wages. Specifically, the program would have the us government work with local and state governments to produce a network of free day care centers, preschool, and in-home care options, while raising child care worker wages to people of comparable public school teachers. This mixture of proposals will cost roughly $700 billion within the next decade, accounting for dynamic effects, according to an analysis from Moody's.

But economists have questioned whether $2.75 trillion is an accurate estimate of wealth tax revenue. Former Clinton administration Treasury Secretary Larry Summers called into question Saez and Zucman's estimate, arguing they dramatically underestimate the enforcement issues with a wealth tax, and said the tax might raise only 40 % of this projection. The University of Chicago Booth School of Business polled economic experts and located that 73 percent either agreed or strongly agreed that the wealth tax would pose much more enforcement challenges than existing taxes due to difficulties of measuring value.

European countries have moved from wealth taxes-12 countries had wealth taxes in 1990, while only four did by 2022. Before those taxes were abolished, they played a small role in revenue generation. These countries recognized that the wealth tax poses real economic problems. They treat personal wealth, just like a mansion, the same as productive business investments like factories or tools, which impedes both enforcement and economic growth.