As the father to sons who're 25 and 17 years old, I love millennials and Generation Z. But it's getting harder and harder to feel sympathy for children born between 1981 and 2012 (give or take).

It's not all-or maybe even mostly-their fault. Much of the problem comes from the methods where the media covers the plight of younger Americans, especially the supposedly catastrophic quantity of education loan debt they've adopted simply to get a degree that is now, we're told, a virtually meaningless sheet of paper that no more \”automatically\” guarantees admittance to the \”middle class.\” A current story in The Wall Street Journal exemplifies this method. It's titled \”Playing Catch-Up hanging around of Life: Millennials Approach Middle Age in Crisis\” and promises \”New data show they're in worse financial shape than every preceding living generation and may never recover.\” Mostly, it highlights individuals and couples who've a lot of student debt and, as a result, supposedly can't buy houses, have kids, or perhaps get married.

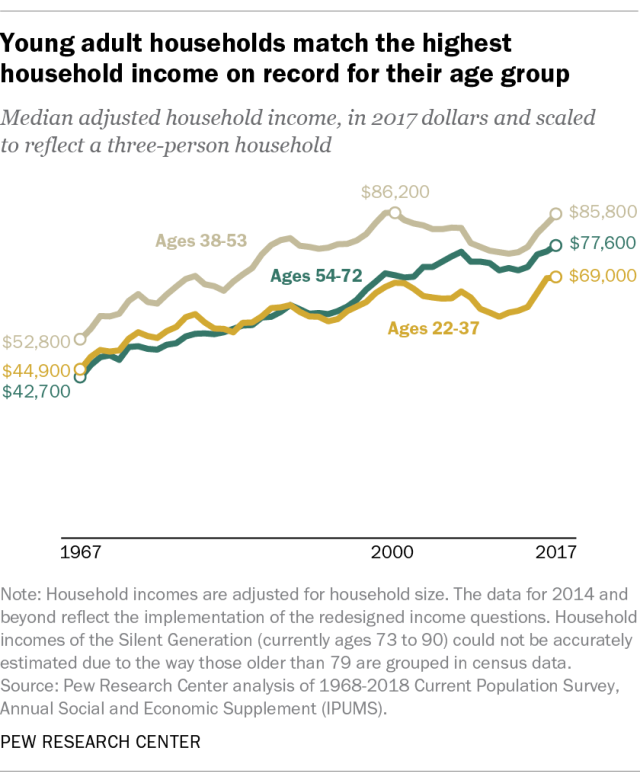

In fact, it is from clear that crude economics is driving, say, the reduction in fertility rates, that have been dropping for decades all around the world and therefore are tied to increases in female autonomy. As well as for all the discuss generational poverty, it's not immediately clear that is darkness. According to a Pew study in 2022, millennial households now \”match the greatest household income for their age bracket.\” Throw in higher rates of advanced education, and also the future actually looks promising. And it appears that millennials might be best in a variety of ways than Gen X was at exactly the same stage of life.

In nevertheless, there is a lot wrong with the narrative about student loan debt that it's difficult to know how to start. In the first place, more and more people, including more low-income people, are likely to college than ever before and college grads cash higher lifetime earnings and much lower unemployment rates than folks with only a high school diploma, an associate's degree, or perhaps a couple of years of school. As the economist Scott Winship has written, \”If we're counting rising student indebtedness around the debt side of the ledger, shouldn't we count the need for the asset financed through the debt (human capital) around the asset side?\” And despite the aggregate $1.5 trillion available in student debt, the average and median amounts owed by individuals students are hardly breathtaking.

According to data from Lending Tree, for example, about 70 percent from the type of 2022 took out loans; their median monthly payment was $222. The typical amount borrowed (which is greater than the median) for graduates with debt involved $30,000. According to Pew:

The median borrower with outstanding student loan debt for his or her own education owed $17,000 in 2022. The amount owed varies considerably, however. One fourth of borrowers with outstanding debt reported owing $7,000 or less, while another quarter owed $43,000 or even more.

So most borrowers are in fact acting responsibly. College grads make about 80 percent more than high school grads, so taking on debt isn't stupid. And even though college has been getting more expensive, the wage premium remains sufficient that the number of years required to recoup the cost of college hasn't increased for decades, based on work made by the New York Federal Reserve:

It's extremely difficult to obtain straight answers about many facets of education-related debt. Often, it's not clear when the debt for a given year includes loans for grad school, including school or medical school, which aren't just much more expensive but also much more remunerative and optional. Ninety percent of law school grads borrow, for instance, and also the average debt load is $127,000 for people attending private schools and $88,000 for all those going to state schools. Three-quarters of med students remove loans that average around $200,000, however the typical doctor makes between $150,000 and $312,000 each year, therefore the debt isn't particularly difficult to pay back. Don't let feel bad for lawyers and doctors?

It's obviously better than finish college with little if any debt. But media accounts inevitably gravitate to people with eye-popping levels of debt which are nobody's fault but their own. Even worse, the reports rarely include any kind of more information that will allow a reader to obtain a better feeling of the individual's life choices. Yes, relatively cheap loans doubtlessly entice many people to go to college who wouldn't when they needed to pay higher rates of interest (if student loans were dischargeable in bankruptcy proceedings, interest rates-even those offered by the us government, which disburses about 90 percent of student loan dollars-would considerably higher). But ultimately the borrower has to be responsible for actions. I say that as someone who paid his way through undergraduate and graduate school and sweated blood every time I signed for students loan. Youth is really a time of great folly, yes, but you know exactly how much you're going to be repaying for exactly how long.

In The Wall Street Journal story, we meet a 32-year-old woman residing in Chicago who \”is a renter who is single and earns $75,000 a year [working for that city]. She also owes $102,000 in student loans and $10,000 in credit-card debt.\” Her salary is actually type of great, especially for someone her age. The median household income for Chicago is all about $53,000 and also the median per capita income there's $33,000. She's got three times the typical student debt, but we've no way of knowing where she visited college or whether there is a grad degree tucked into that.

Making $75,000 annually breaks down to $6,250 a month. Assume she's paying 33 percent as a whole taxes, which brings her monthly take-home pay to around $4,200. Assuming she's paying 7 percent on her loans, she's responsible for about $1,200 a month, leaving $3,000 to cover rent, food, and everything else. That's not great, but it is doable. In tangible dollars, it comes down to $20,000 more than I was buying in the mid-'90s when I started at Reason and lived in La having a non-working spouse and 1-year-old son. Does she have roommates? Why did she spend so much on college? Reading this story helped me consider last year's Time cover story on teachers who supposedly needed to work 2 or 3 extra jobs because they're \”not taken care of the work [they] do.\” So much of household finance is associated with spending levels, that are never really discussed.

We also meet a thirty-something couple that \”run a financial-advice website, whittling away in their combined student debt of $377,000.\” What? One of them is really a lawyer, why don't we think that as much as $127,000 from the debt went toward a private school law degree. There's still a quarter of the million dollars in student debt to account for. The story doesn't provide any extenuating circumstances and, to tell the truth, I can't imagine any that will explain such as situation other than really dumb choices. Don't let as a society anticipate to forgive such mistakes via universal debt relief programs proposed by politicians for example Sens. Elizabeth Warren (D -Mass.) and Bernie Sanders (I -Vt.)? That seems like an insult and an outrage to everybody, parent and student alike, who scrimped and saved and went to schools they might afford.

In an Associated Press story about Robert F. Smith, the billionaire who just announced he'd repay all of the student debt of Morehouse College's class of 2022, we meet a 22-year-old finance major by having an inexplicably and shockingly large quantities of student debt-$200,000, a sum that will take him 25 years to repay \”at half his monthly salary, per his calculations.\” When Smith made his pledge during Morehouse's commencement, the student wept.

\”I don't have to live off of peanut butter and jelly sandwiches. I was shocked. My heart dropped. We all cried. Within the moment it was like a burden had been taken off.\”

Surely I'm not the only one who's wondering how the hell someone-a finance major, of all people-ended up $200,000 in hock by graduation. The entire list price for Morehouse is nearly $50,000 annually, but the average net price is $32,000 after scholarships and grants are considered. Even when he put all four years on loans, that should be $128,000, not $200,000. More to the point, who would do this? The average net cost of nearby Georgia State is $15,000. Borrowing $200,000 for any bachelor's degree is simply inexplicable.

I've written often about how younger Americans truly are being screwed by my own generation, the baby boomers. Old-age entitlements really are a brutal form of generational warfare that systematically rob from the relatively young and poor in order to share with the objectively old and rich. The 2008 financial crisis has further beggared the young, who have also developed inside a century with lower-than-average economic growth (thanks, persistent deficit spending and massive national debt).

I've written often about how younger Americans truly are being screwed by my own generation, the baby boomers. Old-age entitlements really are a brutal form of generational warfare that systematically rob from the relatively young and poor in order to share with the objectively old and rich. The 2008 financial crisis has further beggared the young, who have also developed inside a century with lower-than-average economic growth (thanks, persistent deficit spending and massive national debt).

Older us citizens have a large amount of explaining to do, and we have to reform a variety of policies that slow economic growth and direct all sorts of unearned wealth to people who don't require it. But younger Americans-at least those who have the ability to royally screw up their finances by graduation day-also need to be held accountable.