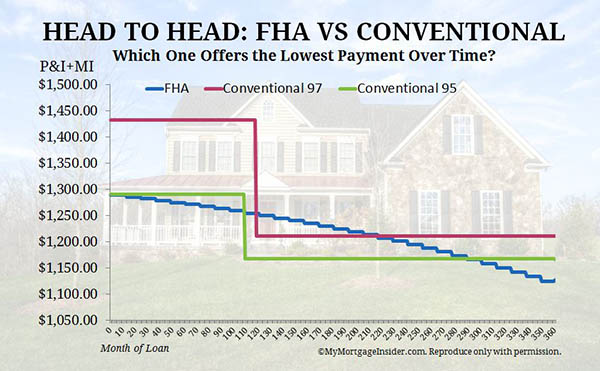

Q: I have good credit of approximately 730. I meet the requirements for both FHA and Typical 97. I want to live in the home pertaining to 6+ years. Which has lessen payments and what is the main difference between the FHA bank loan and conventional loan? Also what are the policies around closing costs?

-Dave

A: Hello Dave. Thanks for the concern. First let’s start together with the main difference between any FHA and classic loan programs.

FHA: This is a government-backed plan that requires a 3 or more.5% down payment. FHA financial loans are best for borrowers who may have lower credit than it takes to qualify for a conventional loan. However, those with higher credit history might choose them for other reasons.

Conventional: Now you have an “open market” loan type. In other words, the borrowed funds is not directly guaranteed by the government. Preferably, investors within the start market buy investment instruments containing regular loans. Since zero cost market investors wish low-risk investments, conventional financial products are geared designed for?lower risk