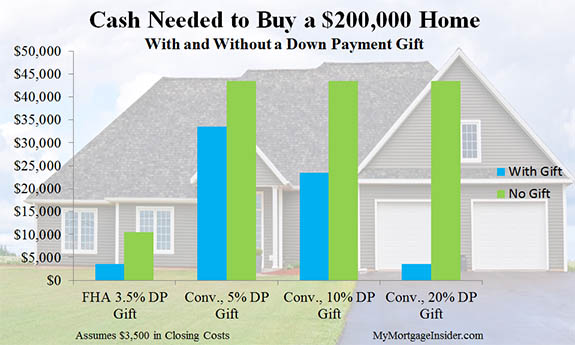

One thing you should know as a first time or perform repeatedly home buyer is that mortgage lenders allow financial presents to get used toward the down payment at a home. ?Gift funds are a priceless tool for first time home buyers and repeat purchasers alike. Yet, first-timers are usually the ones who assist the most from this credit guideline.

If you are looking for a?first time home buyer program, discover the possibility of receiving a put in gift. Buyers can use a gift?for?conventional loans, as well as Home loans, USDA and VA. In fact,?FHA reward funds can reduce the buyer’s required money?to zero.

>>Examine how much home you really can afford. Click here.<<

No matter what type of mortgage you will apply for, something special from an qualified source can give you a leg up when qualifying for your first home mortgage.

Using Products with Conventional Financing

Conventional personal loans backed by Fannie Mae together with Freddie Mac allow the buyer to apply financial gifts to the down payment, prices, and closing costs.

The consumer usually does not need their particular funds when getting a gift?if the gift covers the entire down payment as well as other loan costs.?In the past, the borrower necessary?5% of their own money, but this is no longer the case for most transactions. Based on Fannie Mae, the minimum 5% customer contribution?is only needed when:

- The gift amount of money is less than 20% in the purchase price, and

- The property is your duplex, triplex, or four-plex (2-4 units)

- Or, if the loan amount is over $424,100

To shed light on, the borrower doesn’t have any of their very own own cash when receiving a treat that covers your whole down payment and closing prices, unless the final the amount you want is over $424,100. In case the gift amount would not cover all upfront costs, the customer needs to prove they already have the money to cover these individuals, or receive a better gift amount.

>>Look at today’s rates for ones upcoming home purchase.

You may be thinking that it really is pretty rare for someone to give away enough revenue to cover the entire pay in and closing costs. However ,, it happens a lot more than it’s possible you’ll realise, and has allowed countless homebuyers to achieve home ownership much earlier than we can have on their own.

FHA?Gift Funds

Gift funds can reduce the level of time it takes to save for a down payment.

The typical FHA consumer makes a Three or more.5% down payment on the dwelling. This means that if the price is $100,000, your borrower needs to put together $3,500. For an Federal housing administration loan, this A few.5% is called the required “minimum purchase.”

The minimum investment is a FHA’s way of making sure a homebuyer has “skin inside the game” which lowers likelihood of foreclosure.

But there’s 1 exception to the minimal investment rule. This?can be a financial reward. That’s the difference between Federal housing administration mortgages and conventional. Federal housing administration mortgages allows any or all with the 3.5% minimum expenditure to get a gift. Borrowers do not need to contribute their particular funds if finding a gift for the comprehensive 3.5% down payment.

Click right here to check your home buying eligibility — free.

Down Fee Gifts with?USDA loans and VA loans

Using gifts on Usda and VA personal loans is not as common, mainly because are both zero all the way down programs. However, credit seekers may find themselves in times where they need to obtain a gift for these financial loan types. For instance, when the appraised value much less than the purchase price or maybe funds are needed for closing costs.

US Department of Farming Rural Development (USDA RD) loans allow the use of gift cash to be useful to cover virtually any down payment required or maybe closing costs not presently covered by the seller. In the same way, Veteran’s Administration (VA) lending options allow gifts. Both for of these programs, continue with the same donor rules and documentation techniques as for conventional loans.

Check today’s mortgage rates. Click here.

Who can Give Gifts?

Typically, contributor of financial gifts in the direction of purchasing a house must be relatives. According to Fannie Mae’s underwriting guideline, a giftor can be “a comparative, defined as the client’s spouse, child, or any other dependent, or by other individual who is related to the borrower by simply blood, marriage, adopting, or legal guardianship.In In addition, a fianc