LendEDU Rating (4.25 / 5.0)

For Above Average Credit

- Prosper Personal Loan

- Product Information (4.3 / 5.0)

-

- Application Process (4.0 / 5.0)

-

- Post Application (4.5 / 5.0)

-

- In-Depth Insights (4.2 / 5.0)

-

- Learn more about our ratings & methodology

“>See Full Ratings

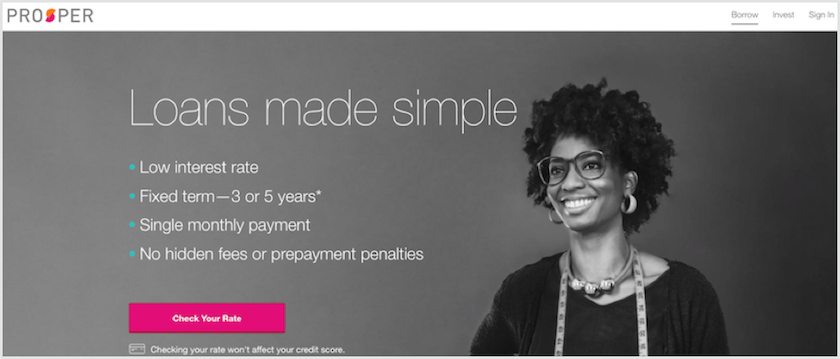

What we like:

Availability of customer support and various resources for consumers

Starting up in 2006, Prosper debuted alongside ??Lending Club as one of the country’s first peer-to-peer lending marketplaces which is a marketplace where individual investors are able to provide funding commitments for loans to borrowers through the marketplace (hence the ??peer-to-peer aspect). The private loan marketplace is run through Prosper.com which is operated by Prosper Marketplace, Inc.

Prosper has facilitated the funding of over $12 billion in loans since its founding twelve years ago. This makes it one of the largest personal loan marketplaces in America. This makes sense as it is one of the first companies to take up on the idea of peer-to-peer lending.

Prosper’s Personal Loan Offerings

Prosper provides a wide list of reasons and applications for personal loans. The options ranges from common expenses, projects, debt payments, or even unexpected expenses. Here is a more detailed list of what kind of personal loans are available to borrowers applying for a loan through Prosper.

- Debt Consolidation

- Medical Expenses

- Dental Expenses

- Business

- Large Purchases

- Household Expenses

- Automobile Purchases

- Motorcycle/RV/Boat Purchases

- Special Occasion

- Vacation

- Taxes

- New Baby/Adoption

- Other

It is clear that there is an extremely wide range of criteria for a personal loan through Prosper.

Loan Amounts

First and Foremost, Prosper personal loans range from $2,000 to $40,000 for any of the purposes mentioned earlier. This is a somewhat smaller range than other competitors which reveals some limits to borrowing through Prosper.

Interest Rates

These loans are offered with annual percentage rates (APR), ranging from 5.99% to 36.00%. These rates are only fixed, and they are dependent on credit score and loan size. The APR is different from the interest rate of a loan through Prosper. The APR includes the interest rate of a given loan and an origination fee expressed as a percentage. The best interest rates with the origination fee taken into consideration are what Prosper advertises.

APRs on a loan through Prosper are dependent on credit history. Poorer credit history may result in higher APRs on a personal loan while better credit scores may receive lower APRs. This can be attributed to the use of a backward looking underwriting process which often bars borrowers with poor credit from qualifying for a loan.

FIND MY RATE

on? Prosper’s secure website

Repayment Terms

Prosper advertises standard personal loan repayment period plans; for instance, borrowers can choose between either a 3 year plan or 5 year plan*. Considering these payment terms defines monthly payments. 5 year plans generally have lower monthly payments, but they allow interest to build more over time on a personal loan. On the contrary, 3 year plans set an aggressive track towards paying off a loan with higher monthly payments.

Fees

One positive aspect of a loan through Prosper is the lack of a prepayment fee, which is a standard for many personal loans. If a borrower happens to pay off a loan one year earlier, there will be no additional fee. While pre-payment fees may seem absurd, many lenders or lending partners technically view prepayment as a breach of contract which can be taken as grounds for additional compensation. A prepayment fee is not an issue while borrowing through Prosper.

Benefits

The speed and ease of application and disbursement is an aspect of applying through Prosper that requires mention. The application for a personal loan takes only a few minutes to complete. Approval feedback is provided almost instantly after submitting an application. The only downside to the application process is how long it takes to disburse the funds which can take up to a week.

Another benefit of borrowing a private loan through Prosper is the customer support. There are various resources available online that help borrowers answer commonly asked questions for themselves. There are over fifty articles that can help solve a variety of problems that a borrower may encounter. If that is not enough, then there are several ways to contact Prosper directly. The first involves reaching customer support by phone. The second includes contacting Prosper via email. There are also opportunities to provide feedback in a survey which can help improve service in the future.

APPLY TO PROSPER

on? Prosper’s secure website

Final Thoughts

Prosper is one of the oldest personal loan marketplace lending platforms with an established foothold in the industry. In many ways, it has defined the way personal loan lending partners operate in the online marketplace.

Overall, Prosper is a great marketplace to tap into with good or excellent credit. It offers plenty of perks to those looking to consolidate debt or handle an unexpected medical bill, making it a competitive marketplace lending platform in the personal loan industry.

* For example, a three-year $10,000 loan with a Prosper Rating of AA would have an interest rate of 5.31% and a 2.41% origination fee for an annual percentage rate (APR) of 6.95% APR. You would receive $9,759 and make 36 scheduled monthly payments of $301.10. A five-year $10,000 loan with a Prosper Rating of A would have an interest rate of 8.39% and a 5.00% origination fee with a 10.59% APR. You would receive $9,500 and make 60 scheduled monthly payments of $204.64. Origination fees vary between 2.41%-5%. APRs through Prosper range from 6.95% (AA) to 35.99% (HR) for first-time borrowers, with the lowest rates for the most creditworthy borrowers. Eligibility for loans up to $40,000 depends on the information provided by the applicant in the application form. Eligibility is not guaranteed, and requires that a sufficient number of investors commit funds to your account and that you meet credit and other conditions. Refer to Borrower Registration Agreement for details and all terms and conditions. All loans made by WebBank, member FDIC.

4.15