![]()

LendEDU Rating (4.60 / 5.0)

For Above Average Credit

- Citizens Bank Personal Loan

- Product Information (4.7 / 5.0)

-

- Application Process (4.7 / 5.0)

-

- Post Application (4.5 / 5.0)

-

- In-Depth Insights (4.5 / 5.0)

-

- Learn more about our ratings & methodology

“>See Full Ratings

What we like:

Extensive loan term lengths and personal customer support

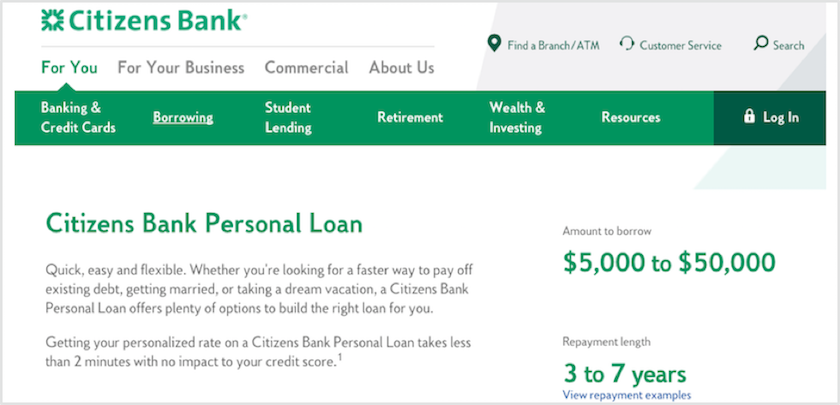

If you are in need of a personal loan for consolidation, refinancing, taking a dream vacation, getting married, or another reason, you need a reliable loan. Citizens Bank offers low interest personal loans so you can achieve your financial goals sooner than you may have anticipated.

Citizens Bank literally puts the “personal” back in personal loans. With a personalized rate, you can secure a loan specifically designed for you. All it takes is less than two minutes of your time. Better yet, you will not only save time, but your credit score will not be compromised. You can apply via the website or call to speak to a Citizens representative. You will receive the loan decision and applicable rate instantly.

At a Glance: Citizens Bank Personal Loans

|

Interest Rates |

5.99% – 16.24% |

|

Loan Amounts |

$5,000 – $50,000 |

|

Loan Terms |

3 to 7 years |

|

Origination Fee |

None |

|

Check Rate at Citizens Bank’s ?secure ?website |

Citizens Bank’s Personal Loan Offerings

A personal loan is a great option for borrowing money when you need it the most. By borrowing only what you need, you do not have to worry about having to take out an excessive amount for a loan.

Citizens Bank allows you to take out a loan between the amounts of $5,000 and $50,000 at fixed rates.

Repayment terms range between 3 and 7 years. In addition to choosing a specific amount for the loan, a quick response is guaranteed. Documents can be signed and uploaded to Citizens Bank conveniently and easily for quick closing.

Fixed rates range from ?5.99% APR – 16.24% APR.

However, the benefits don’t stop there. Repayment customization is an advantage when going through Citizens Bank for a personal loan. You can choose a repayment term and interest rate that best fits your preferences. Monthly payment amounts vary and can be chosen based on your income, as well as how much you can afford to pay.

Reasons for Getting a Personal Loan With Citizen’s Bank

Debt Consolidation

Extensive monthly payments that just seem to come one right after another are overwhelming. As soon as you make one credit card payment, you may have another high payment due a few days later. As a result, you might end up paying only the interest, as you can only afford the minimum payment due. Ultimately, you feel as though you will never get the card balance paid off.

Thankfully, there is a solution. With debt consolidation, you can make your payments simple, and pay off the debt faster. Citizens Bank offers debt consolidation. With proper approval, you would only have one monthly payment, as all of your debt would be rolled over to one balance. Estimating payments before submitting your application is possible before accepting any terms.

Vacation

Everyone deserves to go on vacation. However, it may seem like you will never be able to experience one when bills pile up. Although you are probably a responsible adult who takes care of bills before doing anything fun, you can still have the vacation of your dreams by taking advantage of a Citizens Bank personal loan. Before you decide on accepting any terms for a personal loan, you will have the opportunity to estimate your payments. That way, you do not have to worry about committing to something you may not be able to afford to pay back.

Special Occasion

With debt and other obligations, it can be hard to make lifetime memories. Whether you are longing for the perfect wedding day or another unforgettable event, you want everything to be perfect. With a personal loan from Citizens Bank, you do not have to worry about committing to more money than you actually need. By getting only the amount of money needed, you will feel less overwhelmed when it comes to paying the loan off. Whether calling or applying online, you will have a decision in a matter of two minutes or less.

Major Purchase

Whether you need a new refrigerator, washer and dryer, or other ?household necessity, a personal loan from Citizens Bank is just what you need. When you are in a bind but something major comes up and you need additional funds, Citizens Bank is there for you, as long as you have a decent credit score and credit history.

Income, Credit, and Fees

To qualify for a Citizens Bank personal loan, there are some requirements regarding income and credit. To receive a personal loan you need to have a minimum income of $24,000. Just like any other loan, a strong credit history is required. Some personal loan companies impose fees, however, when it comes to upfront expenses for Citizens Bank, there are no origination, application, or disbursement fees.

Whether you are in a bind and have no other option or you are looking to take your dream vacation, Citizens Bank can help. By requesting a rate quote your credit score will not be impacted. If you choose to submit your application you will receive the funds through your U.S bank account listed in your name.

Obtaining a rate quote is convenient as well. Simply access the “Get My Rate” button via the website or call to speak to a bank representative. All you need is your social security number, address, phone number, loan amount, and an email address to process the application. You will be feeling less financially overwhelmed in no time.

APPLY NOW

o?n Citizens Bank’s secure website

4.63