- How to calculate your debt-to-income ratio

- Why do lenders worry about my debt-to-income ratio?

- When will lenders look at my debt-to-income ratio?

- What is a good debt-to-income ratio?

- How can I improve my debt-to-income ratio?

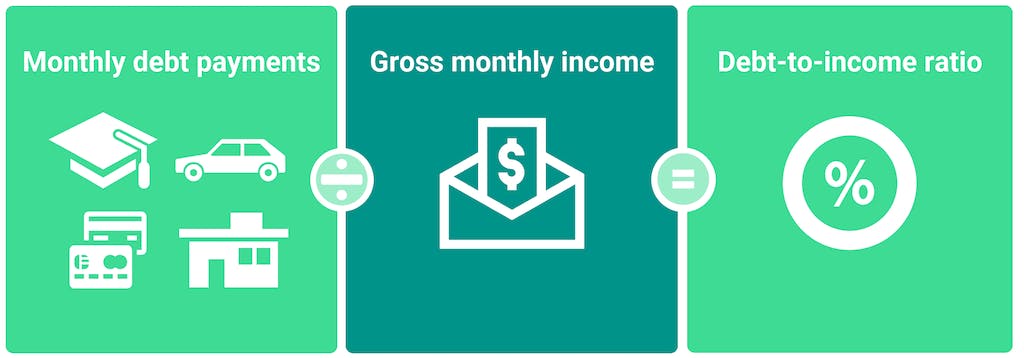

How to calculate your debt-to-income ratio

To calculate your DTI, accumulate the total famous your monthly debt payments and divide this amount by your gross monthly income, that is typically the amount of money you make before taxes along with other deductions every month.

Let's consider an example. Say your gross monthly income is $6,500 as well as your debt payments total $3,000. Here's the way they break down.

| Monthly bill | Payment |

|---|---|

| Auto loan | $500 |

| Personal loan | $400 |

| Student loan | $500 |

| Credit cards | $600 |

| Mortgage | $1,000 |

| Total | $3,000 |

Here's how you'd calculate your debt-to-income ratio.

$3,000/$6,500 x 100 = 46.2%

Why do lenders worry about my debt-to-income ratio?

When a lender considers whether or not to allow you to borrow money, it wants here is how you handle your finances – both past and offer. So lenders will appear at different factors – like your credit history, credit scores and debt-to-income ratio – to obtain a concept of your financial picture.

When lenders see a healthy debt-to-income ratio, it can benefit them feel well informed that you'll be capable of making your loan payments. This might assist you to be eligible for a financing.

When will lenders take a look at my debt-to-income ratio?

The tactic to take a loan differs with respect to the type of loan and lender, but in general, lenders want the most accurate picture of the finances they are able to get before deciding whether or not to loan you money. This means that your debt-to-income ratio might be a part of their calculations.

Mortgages

It can be particularly helpful to know what your debt-to-income ratio is before applying for any mortgage, because mortgage brokers often have strict DTI ratio requirements.

Some mortgage brokers will only consider you for any mortgage if your DTI ratio is under a certain percentage. Based on the Consumer Financial Protection Bureau, 43% is usually the highest DTI ratio a borrower can have to obtain a qualified mortgage. On the other hand, some mortgage loans, for example FHA loans, may allow a higher DTI ratio.

Personal loans and auto loans

With personal loans and auto loans, you might be in a position to be eligible for a financing with a DTI ratio higher than the normal 43% cap for a qualified mortgage. However, you should pay close attention to your rate of interest and payment per month to ensure it's affordable for you.

Wells Fargo, for example, says that if you have a DTI of 35% or less, you may be in pretty good shape.

What is a great debt-to-income ratio?

A lower debt-to-income ratio is a great indicator that you're able to take on more debt and repay it.

Keep in your mind that any kind of debt, including student loans, credit card balances, automotive loans, unsecured loans or mortgages, can increase your DTI ratio – as well as costs like supporting your children or alimony payments.

On the flip side, income out of your job, together with any part-time or freelance work and any alimony payments you obtain, can count toward your revenues. Therefore it is essential that you keep an eye on all your debts and income in order to monitor your DTI ratio.

How can I improve my debt-to-income ratio?

There are a number of methods for you to try to improve your debt-to-income ratio. The fundamental idea is cutting your debt or upping your income. Here are a few ideas.

- Pay down debt early. If you have room in your finances, make more than the minimum payments on your debts every month so you outlay cash down faster. For example, pay more than your minimum credit card payment each month.

- Cut monthly expenses to repay more debt. Review your budget and consider methods for you to adjust your spending allowing you to have more money to use toward debt repayment.

- Consider a debt-consolidation loan. If you can't make extra payments in your debt or trim your budget, a debt-consolidation loan might be a good option. This may help you reduce the interest you pay when you try to reduce your debts.

- Get a side hustle or request a raise. Extra income from side jobs can count toward your earnings when you calculate your debt-to-income ratio. The boost in salary you'd get from an increase may also assistance to lower your DTI.

What's next?

Your debt-to-income ratio is an important number to understand if you're thinking about trying to get a loan or other credit.

If your DTI is simply too high, it may stop you from obtaining the loan you would like. But when you are able to think of a plan to reduce your debt or improve your income, you are able to work on cutting your DTI, which might enhance your chances of qualifying for a loan.