Question:

Dear Steve,

I defaulted on student loan, wages going to be garnished, called to see about paying it off in full and they said it is better to do the rehab program for credit.

To me it makes more sense to pay off the $9000. since I have the money, but according to lady I talked with she said doing the rehab program is best route? Is it?

Donna

Answer:

Dear Donna,

Wow. Call me skeptical but the agent you spoke with might be marching on company policy than common sense.

Who knows what her intention is but from public contracts with student loan collection agencies there is a greater financial incentive to put you into a rehabilitation than accepting a full payment.

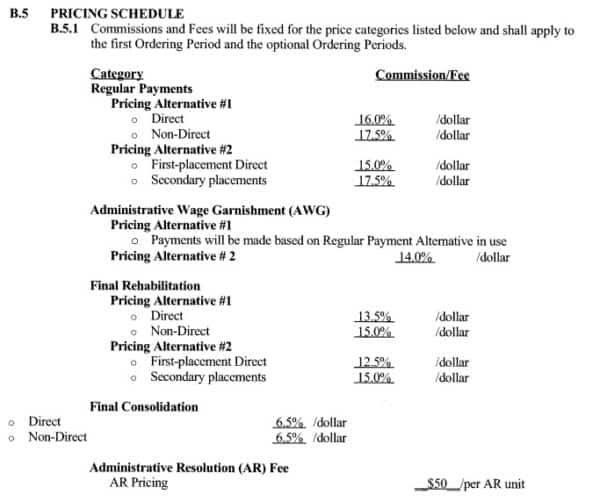

As an example, according to this contract with the Department of Education, GC Services is paid between 12.5-15% of the loan balance for a rehabilitation.

It’s not clear if a full payment is treated differently than a regular payment but clearly, being able to put the debt behind you, close the door on it, and move forward has some distinct advantages. Maybe a full payment is treated like a final payoff in a consolidation where the commission rate is much less at 6.5%

Ultimately the best route is to eliminate the debt and start saving the money you would have used towards that debt each month to save, invest, and use a bit to have some fun.

Please post an update in the comments and let me know what you decide to do.