Question:

Dear Steve,

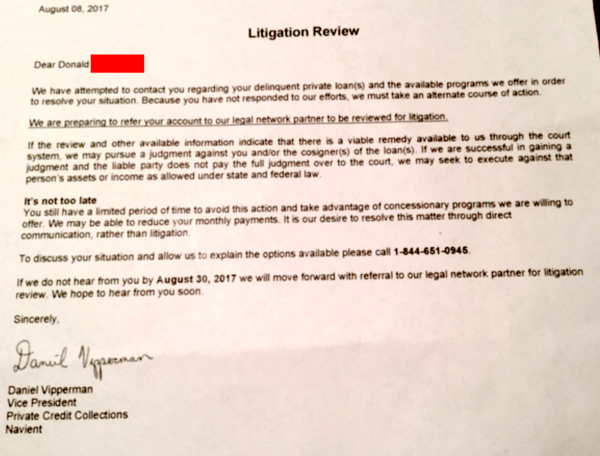

I took out a private loan in 2008 called Sallie Mae at the time for $40,000 and now has changed names to Navient . I was paying on it ever since 2008, never missed a payment , but just finally got tired of making payments on something that wasn’t going away . So I stopped paying them January of this year. I just recentlly received a letter from Navient saying they will pursue further action and try to file a judgement against me if I don’t respond to their letter by August 30th .

I have several loans other than the Private loan that are government loans . I am current with all these loans except for the Navient private loan. I have a total loan excess of $300,000.

What do I do about this letter from Navient threatening to try and file a judgement against me if I don’t respond by August 30th?

I’ve also heard about something called “collection proof” that even if they filed a judgement against me , because I have so few personal assets , that they might not be able to attack me anyway ? I am not sure .

I will try and upload the document to here if I can . If I can’t , can you give me another source to get the document to you

Truly grateful

Donald

Answer:

Dear Donald,

Defaulting on private student loans can be a strategy to deal with a larger issue. But simply getting tired of making payments is not the world’s best reason. Hopefully there is more behind the decision than just that.

The first area I’d suggest you tackle is your federal student loans and make sure you have consolidated those into a new Direct Loan and have opted for one of the Income Driven Repayment (IDR) repayment options to lower those payments as much as possible. This will give you room to make the private student loan payment. It’s not a perfect solution but it will give you some breathing room.

Now that your private loan is so far behind I would expect the balance has really accelerated and has had additional collection fees tacked on to it.

The worst thing to do at this time is ignoring the situation without a plan.

The lender has the legal right to pursue in accordance with the law and contract you signed to take out the loan. They can sue you, go for a judgment, and attempt to levy or garnish your wages. While you might be “judgment proof” at the moment that would require you to not only have no assets, but no income as well. The odds are you will not remain in this condition and at some point in the future the lender could attempt to execute the judgment.

Since you are so delinquent now I would encourage you to seek professional assistance to negotiate a settlement on the defaulted private student loan. It is going to be the most affordable way to repair this situation.

You can contact Damon Day for specific advice or talk to one of the attorneys on this list to come up with a game plan on how to handle this now.

Having your account sent out for litigation is not the worst thing to happen. Doing nothing and letting them sue you is.

I’d summarize your situation as not too late yet but if you do nothing you’ll be screwed.