Question:

Dear Steve,

First, thank you so much for your work with Pilot.Dog! I am the veterinarian at our local humane society for the shelter and their spay neuter clinic. It is hard work but I couldn’t imagine doing anything else! If you’re ever in WV, please come visit us and our pups.

My background, graduated in 2011 with over 160k in federal student loans fixed rate 6.5% with 2 small loans (<10k) at variable 2% (now 3%)that are now managed by Mohela. I am aggressively working to pay them off ASAP and make additional payments on them twice a month when I’m done budgeting my paychecks.

I have just over 59k left and hope to get them paid off within the next 2-3years. Other than a mortgage, I have no other debt, and contribute a small amount to a retirement fund. My reportable taxable interest with Mohela was over 13,000 for 2016 and over 11,000 for 2015, I feel like that may be too much, (I may be wrong) but I’m not sure and have no way to prove that without a paper trail, see referenced problem below.

I am having repeated issues with Mohela’s computer software. When I make payments, it takes several days to weeks to post, and sometimes the principle will update but not the accrued interest or vice versa.

I have repeatedly contacted them and have been largely dismissed (they do have a claim that it will take up to 5 business days to post). I’ve found that when I email about a mistake, it gets corrected within 24hrs. But the next time I make a payment, it recurs. I also had a time WAY back when I first started paying, that I noticed the additional money I paid was being applied solely to the loans with the lowest interest rate (2 small loans at2% vs the bulk of my loans at 6.5%) once I emailed about that, it too was fixed and no longer a problem. (Wish I had kept documentation on that, but I didn’t -you live, you learn)

I guess my concern is, this is fine that I’m catching these mistakes but I’m worried that I may be missing them and it is costing me money. (I.e. If the interest doesn’t update, do I end up paying double interest). We went paperless a long time ago, and there are no available statements that I can access to compare numbers.

Also, maybe just warn your readers to check any additional money they pay goes where they want, that could’ve been very expensive if I hadn’t caught it.

So my question is, should I delay my additional payment to once a month to allow for better accounting on my end or aside from private loan refinancing (or maybe you know a decent one without prepayment penalties) can I request to switch my loans to another federal servicer? I can’t shake the feeling that Mohela is just the student loan version of sleazy used car salesman and I hate the idea of giving them more of my money then what they should get.

Shanna

Answer:

Dear Shanna,

I would love to drop by and see the good work you’re doing in WV with the local Humane Society. A big hug to you for that.

When it comes to MOHELA or just about any other student loan servicer I don’t even need to look for my shocked face to deal with the experience you’ve had.

Whatever you do, don’t even think of refinancing your federal student loans into a private loan unless you either want to strategically default on them in the future or you want to lose current federal loan repayment options that are not otherwise available.

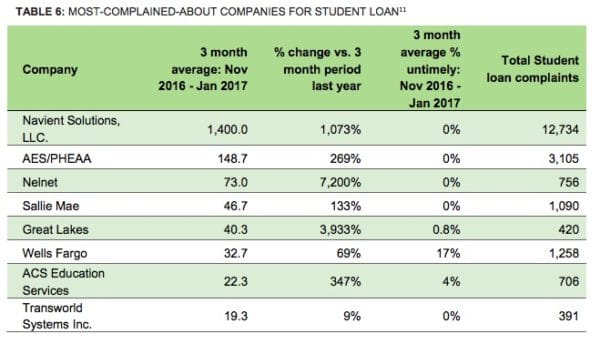

As horrible as the service you’ve received from MOHELA is it’s not even in the top eight of complained about student loan companies to the Consumer Financial Protection Bureau (CFPB).

But in the April 2017 CFPB report they said, “Consumers complain about poor information from and sloppy practices by servicers: Of all the complaints the Bureau receives about student loans, over half-64 percent-are about problems consumers experience when dealing with their student loan servicer. Consumers who reach out to their servicer complain they are not informed about options that would allow them to continue repaying their loan, such as income-driven repayment plans. Rather, consumers complain that their servicer directs them into plans that suspend repayment and cause the interest on their loans to pile up. Consumers also complain that their monthly student loan payments are misapplied by the servicer, which the Bureau believes can cause a range of problems including negative credit reporting and loss of certain loan benefits, such as cosigner release for private student loans.”

I’m impressed in your organization and attention to detail. Great job!

And given the fact this babysitting of MOHELA is not going to change and you are not going to be able to pick your servicer, it makes sense to change your extra payment to once a month or once a quarter. Now, that strategy is going to cost you a small bit of additional interest but in the long run it will probably save you time and money from all the constant chasing of your servicer.

Poor servicer performance is generally not the exception, it’s what I’ve sadly learned to expect. Hell, even Navient is fighting in court and saying they don’t need to provide best advice.

Frankly, I would bet the cost to hire a forensic accountant to check their math is going to be a lot more than any savings you would experience. I wouldn’t even be surprised you’d have to sue MOHELA to get any satisfaction if they found an error. All of that is going to cost you a lot more than just moving forward like the smart consumer you are.