President Biden formally unveiled his student loan debt forgiveness plan on Wednesday, and will use his executive authority to cancel as much as $20,000 of debt for borrowers who make under $125,000 each year.

\”When I campaigned for president, I designed a commitment which i would provide student debt relief,\” said Biden. \”I am honoring that commitment today.\”

Biden will cancel $10,000 of federally held student loan debt for all borrowers who make less than $125,000 annually, and $20,000 for recipients of Pell Grants, which are need-based. The policy will impact as much as 43 million people and cost the government at least $300 billion (in all likelihood, it'll cost you a lot more than that). Ultimately, U.S. taxpayers-many of whom didn't take out loans to pay for school-will be responsible for the money. A really conservative estimate from the cost per taxpayer is $2,100.

According to Biden, forcing all Americans to help pay the debts of college borrowers is definitely an unfortunate necessity; individuals who borrowed in the government to visit school are just that badly off. They are ruined, they're desperate, and they need generous U.S. taxpayers to bail them out.

\”An entire generation has become saddled with unsustainable debt in return for an attempt, at least, in a degree,\” said Biden. \”The burden is so heavy that even though you graduate, you might not have the middle-class life that the college degree once provided.\”

This is quite an indictment of the federal education loan program, so one may have expected that Biden's generous debt forgiveness plan would be accompanied by serious reforms towards the underlying system that produced such inequities. After all, the government is conceding that its loan program has scammed millions of desperate people. Their situation is really dire, their prospects of repayment so dim, that Biden is requiring everyone else to pitch in and enable them to.

But no, Biden's debt forgiveness plan will do nothing-absolutely nothing-to fundamentally alter the incentive system that created the doom spiral in the first place. Degree-seekers will continue to gain access to large amounts of cash to purchase useless educations; indeed, they may feel even more asked to achieve this since this precedent has been set.

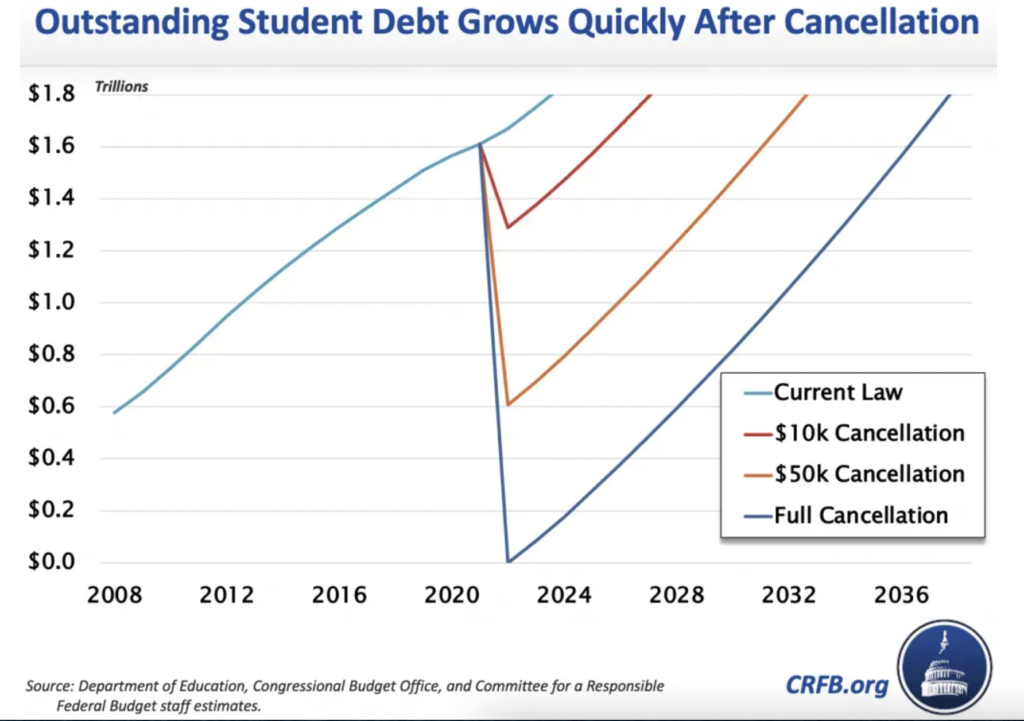

Meanwhile, colleges and universities may have even less incentive to lower costs. Economic scientific study has often found that the government's subsidized student loans cause educational facilities to raise the prices for obvious reasons: If the feds cover the price around the front end, regardless of what it is, universities have every incentive to raise the car or truck. Forgiving education loan debt exacerbates this issue since it encourages more reckless borrowing. Indeed, the Committee for any Responsible Federal Budget estimates the cumulative student debt level will return to current levels in just a few years.

There are structural incentives that push students to gain access to money that they can never aspire to repay, cheap so many people have fallen into crippling debt is an engaging reason to change these incentives. No rule says the us government must lure people down a path that leads to financial ruin with some frequency. Congress can sharply limit, or perhaps end, this practice.

A one-off cancelation of some degree of debt held by borrowers who happen to be in dire straits only at that specific moment does absolutely nothing to fix the underlying problems; on the other hand, it exacerbates them. It's a slap hard to everyone who either paid down their college debt or made different educational choices to avoid accruing it.

If Biden wanted to make the strongest conceivable case for forgiving some college debt, this course of action must be combined with serious changes towards the entire higher education system. Otherwise, he is simply involved in a vast change in wealth, taking hard-earned money from people who did not fall prey to the federal government's scam and awarding it to those who did.