Question:

Dear Steve,

My family went through rough times back when everyone was being laid off. We lost our house and I ended up with only one parent and my brother after all was said and done.

I graduated high school and continued to attend college even though all of what I earned went completely to family bills (rent, food, etc) under family pressure to attend although I knew I wasn’t ready.

I ended up doing a mediocre job (passed all my classes but needed at least a 3.0) in my first year of school and lost scholarship money making it even less possible to afford the private college tuition. Still, I attempted to go another semester (in which I did even worse than the first time failing two classes). Now I am in collections for roughly 5,000 to the school, but I want to go back.

I want to go back to the same school, but I have to pay what I owe to them first. I can’t afford to pay the whole amount right away so I’ve thought about possibly taking out a personal loan for the debt.

I’m not sure if that’s a good idea but just making monthly payments would take me years to pay it off before I could actually go back to school. Do you have any other advice as to how I could possibly get out of that debt as quickly as possible?

Maria

Answer:

Dear Maria,

The first question that comes to mind is what school are you going to that is charging you for back amounts due? I’m primarily concerned you may not be going to the most affordable and effective school. This type of outcome is generally experienced by people who go to for-profit schools.

For example, let’s just say you live somewhere near Knoxville Tennessee.

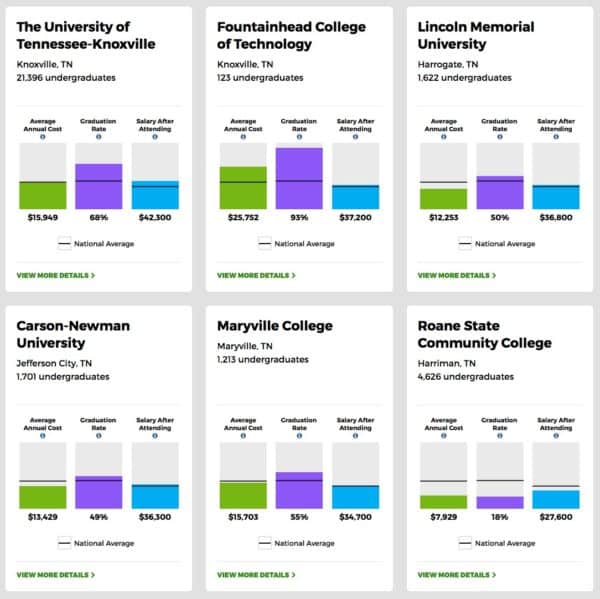

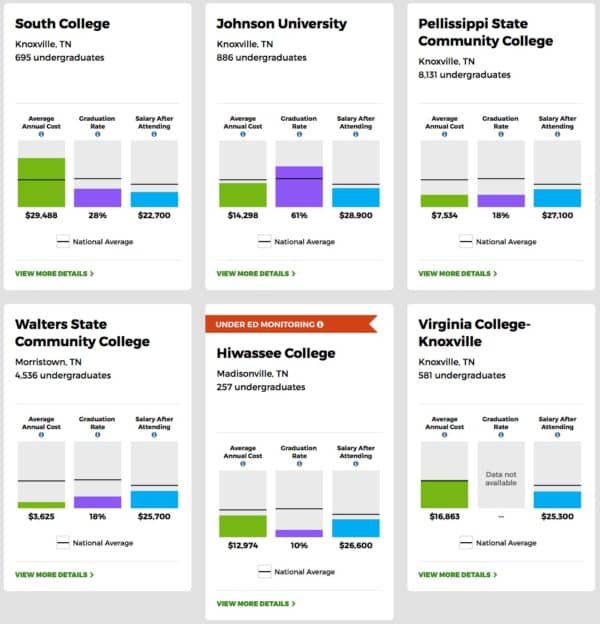

Factoring in federal student loan data here is the performance of schools in that area.

It appears from the data the two schools that are the least expensive, have the higher graduation rates, and higher salaries after graduation are The University of Tennessee-Knoxville and Carson-Newman University.

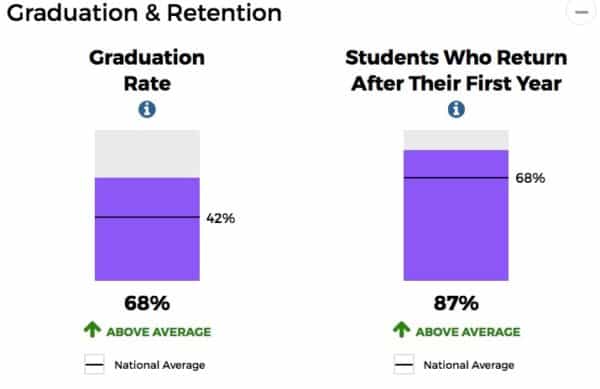

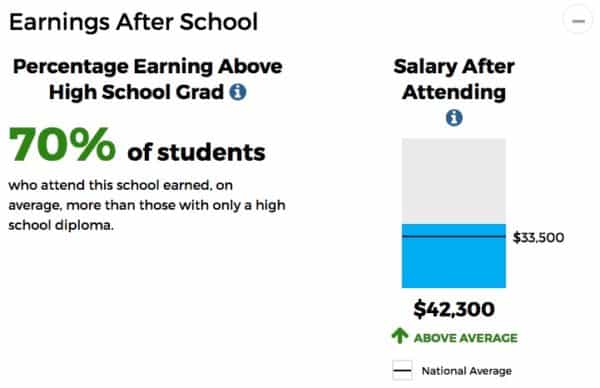

If we dig a little deeper, The University of Tennessee-Knoxville may be even less expensive given your potential family income. And the likelihood of you graduating and getting the most out of your cost of education is impressive.

Can you please post a comment below and let me know what college you were going to and how many credits you had there. Once I know that I can give you some more specific advice on what to do.